f you’re fortunate enough to have some investable money, ChatGPT can significantly boost your ability to find and evaluate great stock opportunities. This isn’t investment advice; it’s a practical demonstration of how you can leverage ChatGPT to enhance your stock market performance.

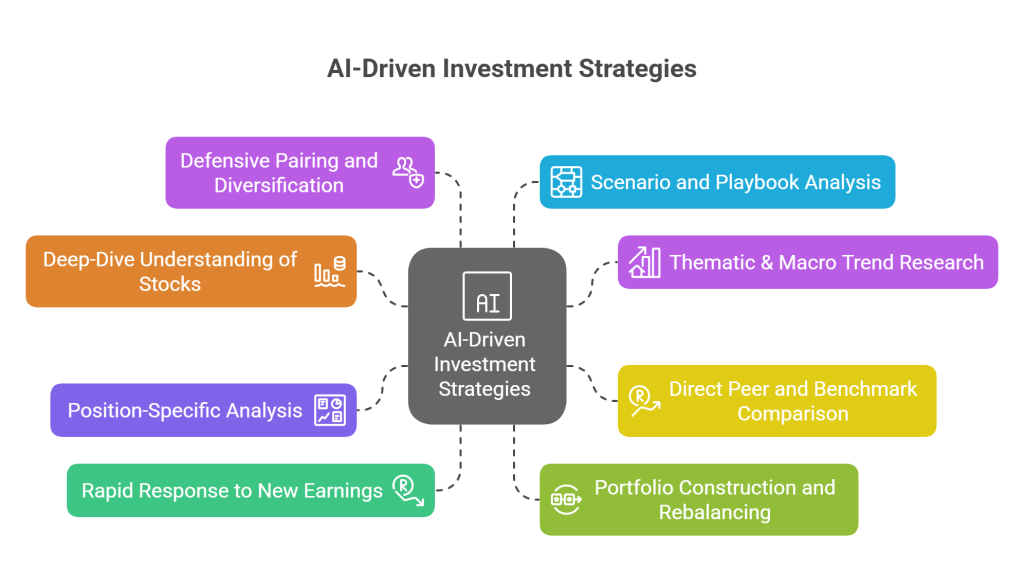

My Overall Approach to Investing with AI

If nothing else, consider utilizing steps 1 and 2 below. The remaining strategies showcase how I personally use AI to support investment decisions. For this, I used ChatGPT O3 version as well as ChatGPT 4.1. Both were excellent and much better than Gemini 2.5. Claude 3.7 was also good and sound information, but I liked the extra information from the Chat GPT as it was able to be more directional.

1. Deep-Dive Stock Analysis

Prompt: “Conduct a comprehensive analysis of [Company X] to determine its investment viability. Include fundamental, technical, and macroeconomic factors. Evaluate revenue streams, financial performance, valuation, industry landscape, risks, growth opportunities, and provide a final investment recommendation.”

Purpose: Generates a thorough, 360-degree report on a stock, highlighting strengths, weaknesses, opportunities, and threats—a robust equity research summary.

2. Thematic & Macro Trend Research

Prompt: “What US-based investment trends are worth exploring based on recent news?”

Purpose: Leverages ChatGPT’s news-awareness to uncover macro trends (e.g., AI infrastructure, pharmaceuticals, defense spending) and identify ticker symbols you might overlook using traditional screeners.

3. Direct Peer and Benchmark Comparison

Prompt: “For the past year, compare [Stock] to [ETF, e.g., SCHB] and [High-performing Stock, e.g., NVDA]—if selling, my funds would be reallocated here.”

Purpose: Determines opportunity cost by assessing not just a stock’s individual merits, but its comparative value relative to potential alternatives.

4. Personalized Position Analysis

Prompt: “Here’s my current holding—still a good hold? Check the latest quarterly earnings before responding.”

Purpose: Delivers tailored advice based on your actual cost basis, gain/loss, and the latest earnings, providing highly relevant, actionable insights.

5. Rapid Earnings Response

Prompt: “Earnings were just announced, and the price has hit my target buy zone—what’s the recommended action? Did the earnings report alter the outlook?”

Purpose: Quickly guides tactical decisions by blending technical indicators with fresh fundamental analysis.

6. Portfolio Rebalancing Guidance

Prompt: “I sold $XX of [ETF] in my Roth IRA and bought $YY of [Stock] at $ZZ. How should I allocate the remaining funds? How does this impact my risk and asset allocation?”

Purpose: Provides instant feedback on how recent transactions impact your portfolio balance, liquidity, and risk profile, suggesting logical next steps.

7. Defensive Pairing and Diversification

Prompt: “Do any of my other target stocks (e.g., PFE, BMY, MRK) serve as good short-term complements to my recent purchase?”

Purpose: Identifies stocks with complementary risk/reward profiles, balancing aggressive holdings with defensive assets to enhance portfolio stability.

8. Scenario and Playbook Analysis

Prompt: “Clarify this tactical idea: ‘Starter tranche <$115, add layers at $100 support.’ Provide examples, set up real-life alerts, and outline actionable steps.”

Purpose: Translates investment jargon into actionable strategies, detailing exact steps, order types, and practical execution tips.

Adapting These Prompts to Your Investing Strategy

- Request actionable advice, not just theoretical knowledge. Always aim for clear, actionable next steps.

- Include current news. Enhance prompts with “consider the latest earnings” or “based on this week’s developments” for timely, relevant responses.

- Balance strategic and tactical prompts. Employ broad comparative analyses for large-scale allocation decisions and specific prompts for immediate trade decisions.