You probably need some guidance and second opinions when it comes to selecting workplace benefits—health insurance, vision, dental. This is a quick reminder that AI can help you evaluate your options and provide personalized insight.

If you’re joining a new job or in open enrollment right now (getting ready for next year’s benefits), you have a lot of important decisions to make for you and your family.

I was previously a life and health insurance agent, but even still—I’d rather have AI run the numbers for me. It helps me evaluate options and does some of the legwork for my annual due diligence on what’s best for me and my family.

This year, my work gave us five different health insurance plans to choose from. I had a hunch about which one was right, but I wanted to confirm it with AI without biasing it by telling it my preference first.

If you’re new to using AI for this sort of thing or want a gentle reminder that this technology can help—this article is for you. This type of decision assistance can easily pay for a year’s subscription to one of these AI services. The best part? You don’t even need a paid model to do this.

Why This Actually Matters Right Now

If you’re reading this in October or November (which you probably are), you’re in the middle of your own benefits enrollment. Most companies run these from October through early December. You have a narrow window to make decisions that affect your entire year.

The problem is simple. You probably just pick the same plan you had last year. Or you go with whatever plan has the lowest monthly payment. You don’t actually do the math. That’s not a great strategy—especially if your health situation changed or your company added new options.

AI can help you actually understand your options. Not just read them. Actually understand them. Without wanting to throw your laptop out the window.

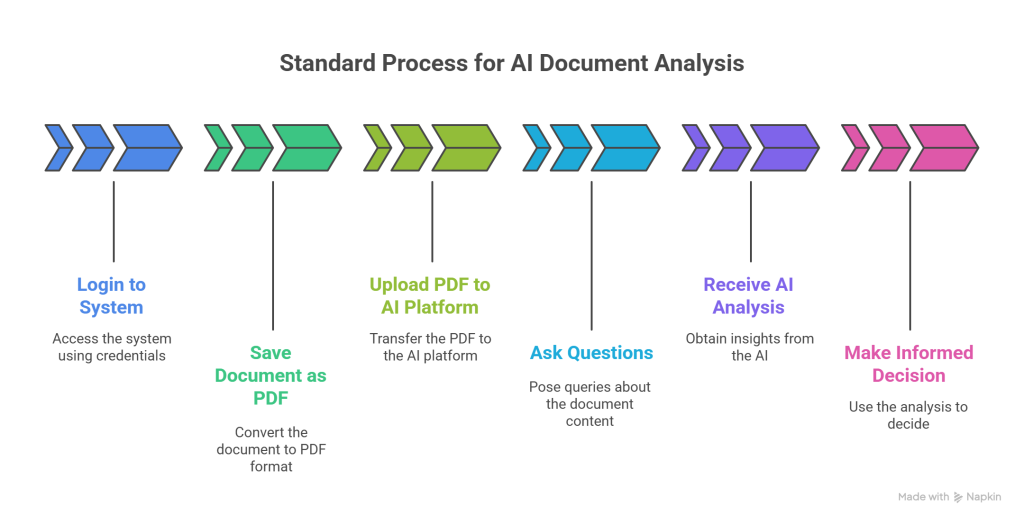

What I Actually Did (The Simple Version)

Here’s my exact process. You can do this in under 30 minutes.

Step 1: Get Your Benefits Information Into One Place

I logged into my company’s benefits portal. I pulled up the medical plan comparison page. Then I saved it as a PDF (File > Print > Save as PDF). Done.

Actually, that’s not quite true. I first uploaded the wrong file—an HTML page with no data. Claude politely told me it was just the portal framework. Second try: uploaded the real PDF with all the plan info.

Step 2: Upload It to an AI (I Used Claude, But Any Will Work)

I opened Claude, uploaded the PDF, and asked:

“I’d like to evaluate these benefits. Could you help me?”

Claude responded with several things it could do:

- Compare total costs under different spending scenarios

- Figure out which plan is better for routine care vs. unexpected expenses

- Calculate the breakeven point between plans

- Explain any confusing terms

Step 3: Ask for the Specific Analysis You Need

I wanted to know one thing: Where’s the breakeven point between these plans?

I cover two people—me and my spouse. We were deciding between a high-deductible plan with an HSA and a lower-deductible copay plan. So I asked Claude:

“At what spend would the $3,400 Deductible HSA plan be beat out by each of the other plans?”

Claude broke it down. Turns out, the HSA plan is the most economical unless we spend more than $11,939 in medical costs for the year. Above that, the $2,200 deductible plan starts saving us money.

That’s a weirdly specific number—but that’s exactly the point. It’s the exact threshold where switching plans stops making financial sense. And we’re not likely to hit $12K in medical expenses unless something major happens.

Step 4: Get a Full Breakdown (If You Want It)

Claude didn’t just give me a number. It generated a full markdown report showing what each plan would cost at different spending levels:

- At $5,000 in annual medical expenses, Plan 1 costs $7,538 total

- At $15,000, it’s still $1,038 cheaper than the next best option

- Only above ~$29,000 would a low-deductible copay plan make sense

That’s the kind of analysis that would take me an hour with a spreadsheet. AI did it in seconds.

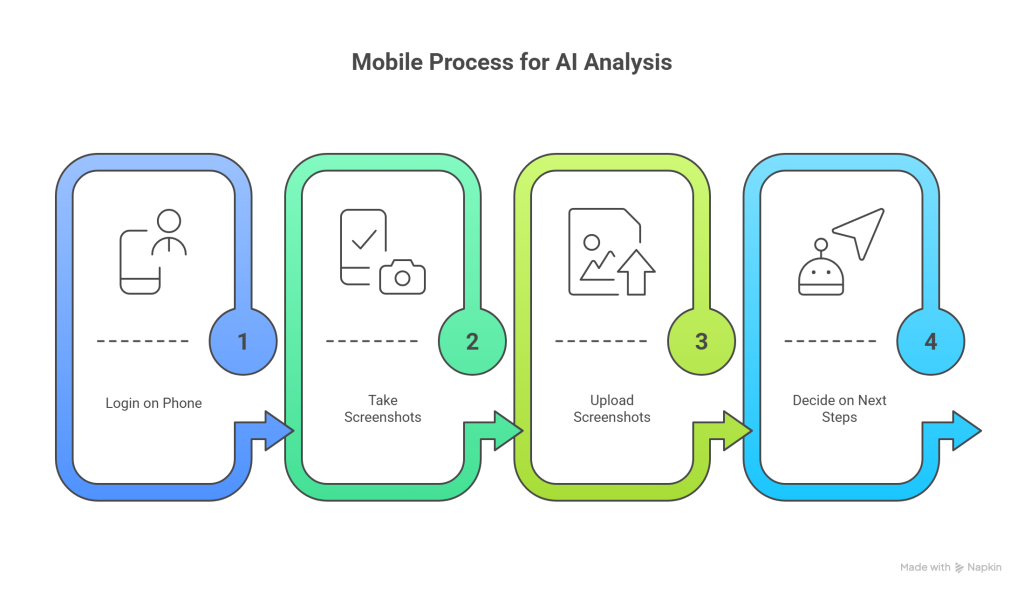

Mobile Version

If you don’t have a computer to login and are doing this on your phone – no worries the process is the same but getting the information to the LLM is a bit different. Here is a process flow for you to follow instead.

What Else AI Can Help You With

There are a lot of jargon terms in insurance and health coverage. Even if you’ve looked at this every year, you likely don’t understand all the terms or need a refresh. AI can explain those in plain English. You can also ask it to:

- Explain what an HSA or FSA is and how much to contribute

- Compare your company’s plans to national averages

- Break down dental, vision, or life insurance options

- Help you decide if optional add-ons (accident, legal, etc.) are worth it

Mistakes to Avoid

Don’t just ask “Which plan should I pick?”

AI doesn’t know your health history or risk tolerance. It can’t make the decision for you—but it can give you the data so you can decide.

Don’t skip the fine print.

AI is great at summaries, but it’s not perfect. Always confirm network coverage, copays, and provider availability yourself.

Don’t forget about HSAs.

If you’re choosing a high-deductible plan, AI can help you calculate the ideal contribution amount for tax savings. Many people overlook this advantage.

Why This Is Worth Doing (Even If You Hate Math)

These sorts of decisions could have a large impact on your family and your net worth. Take your time. Use all the tools at your disposal to make a smart decision.

If you’re navigating open enrollment right now, give this a try. Worst case? You confirm your choice. Best case? You save thousands and finally feel confident about your healthcare decision.